It's also the day of Alvin Bragg's illegal and despicable attack trial in New York on all voters in the U.S. who want a candidate who can destroy wokeism, progressivism, and socialism with a legal, fair election. Bragg, Willis and James are an embarrassment to the legal profession and all Democrats. They are the personification of the 19th century lynch mobs and Jim Crow Redux. And they only go after Trump. They are the crowd cheering for O.J. killing white victims.

Monday, April 15, 2024

April 15--Tax Day and Get Trump Day

It's also the day of Alvin Bragg's illegal and despicable attack trial in New York on all voters in the U.S. who want a candidate who can destroy wokeism, progressivism, and socialism with a legal, fair election. Bragg, Willis and James are an embarrassment to the legal profession and all Democrats. They are the personification of the 19th century lynch mobs and Jim Crow Redux. And they only go after Trump. They are the crowd cheering for O.J. killing white victims.

Friday, May 20, 2022

Who paid federal income tax in 2021--about 40%

Who pays no income tax

"The share of households that paid no federal income tax hovered in the low- to mid-40s until the pandemic. In 2020, it increased to more than 60 percent. This was due in part to massive COVID-19-related job losses and a related decline in incomes. In addition, the three rounds of Economic Impact Payments (stimulus checks) in 2020-2021 were structured as refundable tax credits. And Congress increased the Child Tax Credit for the vast majority of parents. Combined, all this substantially reduced the income tax liability of more than a hundred million households and temporarily turned many from payers of small amounts of federal income tax to non-payers.The share of those not paying federal income tax remained very high in 2021, at about 57 percent. But the economy recovered, federal assistance ended, and the number of non-income tax payers is falling sharply. TPC estimates that only about 42 percent won’t pay federal income tax this year and the share will fall slowly but steadily to the high 30s by the end of this decade.

It also is important to note that many of these households do pay other federal taxes, including payroll and excise taxes. For example, fewer than 17 percent of households will pay neither income nor payroll taxes this year—many of them lower-income older adults. And nearly everyone pays some state or local taxes, including sales taxes."

This is from a rant about a plan to make everyone have some skin in the game. It would raise taxes for those in the middle (the most wealthy already pay more than their "fair share."

https://www.taxpolicycenter.org/taxvox/scotts-skin-game-plan-could-raise-taxes-100-billion-2022-mostly-low-and-moderate-income

Wednesday, February 13, 2019

Some people just don’t get it.

Because of lower taxes, refunds will be smaller. This seems to upset people who prefer to allow the government to use their money before filing taxes.

From the NYT article: "The result is that taxpayers may be paying less over all but still getting a bill after filing their return. That has caught many people off guard."

Proving that it is hard to underestimate the financial understanding of the average American. They paid less taxes, but are still upset

Friday, February 01, 2019

The Middle Class Yarn spun to frighten you

It's not exactly fake news, but it's misleading--the story you hear that the middle class is shrinking and so many more people are using government benefits because of the gap between the very wealthy and the "others." There are three things to consider:

1) demographics/age,

2) marriage or the lack of it, and

3) expansion of federal benefits from the poor and deserving to the middle class.

Rejoice, patriots. It's not true. The middle class is only shrinking because so many people have moved up to the next quintile! Have you ever driven to the suburban areas of Columbus (or the city where you live)--I can't believe the homes, schools, shopping centers, churches, gyms, parts, etc. And the new high rise housing in the central city for all those millennials willing to pay the apartment costs.

Also, as the boomers retire, they are now living on their pensions and investments (the very wealth Elizabeth Warren wants to go after), plus they are drawing Social Security. And guess what, a two parent household with both adults working has a much higher income than a one parent household who is most likely a woman. Two adults in a home have more time to distribute to the children to see to it they are educated and well-fed. It's amazing how many "experts" in socialist think tanks switch to "household" to show poverty rates and don't factor in $30,000 in transferred benefits like EITC, SNAP and Section 8.

We've been in 4 of the 5 quintiles in our 58 years together, as have many our age. We have 5 streams of income, as do many our age--some if they have military benefits have 6 or 7. We're certainly not suffering, but as retirees, we have less INCOME than when we were DINKs, but more WEALTH because we have lived frugally and invested or lived on one income. Warren wants to punish us for living on less when we were in our 40s.

Left of center think tanks crunch the numbers and in horror say, the sky if falling. There's a gap that wasn't there in 1979. We need a more "progressive" system--higher taxes. Well, duh. You mean when we lived in an upper middle class neighborhood of the 70s in a home with 1.5 bathrooms, 2 TVs, 1 phone, 1 car, 1 income, and lived month to month with 2 growing children in our home? Do you mean when we had 1 week vacation, which we spent at Mom's farm, and paid our own health insurance? Do you mean when we had a mortgage and a car payment, but no credit card or college debt (never had that because we never borrowed). Do you mean when FICA withdrawals from our 1 check ended at $22,900 and there was no Medicare tax (now is $127,200 FICA + 1.45% for Medicare)? And the personal exemption? Much higher then. Don't have the exact figure for 1979, but if the 1913 rate (year of modern income tax) of $3000 were adjusted for inflation it would be about $72,000--anyone getting that?

So what has the government done for the poor and low income with all the tax money and safety net money we've sent in the last 40 years? Well, the so-called safety net expanded so much that the middle class now qualifies for many entitlement programs meant for the poor. The middle class voter now screams if there's no COLA for Social Security (which originally was for the poor widows and orphans) and Medicare.

Now 55% of the U.S. population are receiving some sort of entitlement--and it's not because we're poor, it's because we're middle class and wealthy. It's because for every election the politicians dangle an increase for the population served by Social Security, or one of our 5 health insurance programs. Government programs NEVER get smaller--they always expand, and since there are so few poor people in America, they expand into the middle class. There are people earning over $100,000 who qualify for government benefits--even Obamacare.

Monday, January 14, 2019

Social Insurance and Retirement Payroll Taxes

From: Overview of the Federal Tax System, 2018, p. 15 Congressional Research Service, March 29, 2018

“Payroll taxes are used to fund specific programs, largely Social Security and Medicare. Social Security and Medicare taxes are generally paid at a combined rate of 15.3% of wages, with 7.65% being paid by the employee and employer alike.

The Social Security part of the tax, or the old age, survivors, and disability insurance (OASDI) tax, is 6.2% for both employees and employers (12.4% in total). In 2018, the tax applies to the first $128,400 in wages. This wage base is adjusted annually for inflation.

The Medicare portion of the tax, or the Medicare hospital insurance (HI) tax, is 1.45% for both employees and employers (2.9% in total). There is no wage cap for the HI tax (the Medicare HI tax applies to all wage earnings). Certain higher-income taxpayers may be subject to an additional HI tax of 0.9%. For married taxpayers filing jointly, combined wages above $250,000 are subject to the additional 0.9% HI tax. The threshold for single and head of household filers is $200,000. These threshold amounts are not indexed for inflation.

Employers may also be subject to a federal unemployment insurance payroll tax. This tax is 0.6% on the first $7,000 of wages. Federal unemployment insurance payroll taxes are used to pay for the administrative costs of the unemployment insurance (UI) program. State UI taxes generally pay for UI benefits.

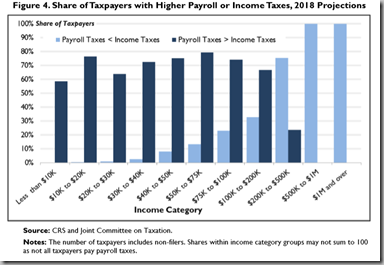

Most taxpayers pay more in payroll taxes than income taxes. The JCT [Joint Committee on Taxes] projects that in 2018, 67% of tax units will pay more in payroll taxes than income taxes. Most low- and middle-income taxpayers pay more in payroll taxes than in income taxes. [They pay zero income tax because of our progressive tax system.] Nearly all taxpayers with incomes of $30,000 or less pay more in payroll taxes than income taxes. Up through the $100,000 to $200,000 income category, the share of taxpayers paying more in payroll taxes than income taxes exceeds the share of taxpayers paying more in income taxes than payroll taxes.”

Saturday, November 18, 2017

Will there really be more jobs with a tax cut?

In this example of 9 different filers some get more than others, but the only ones losing are a married couple, Laura and Seth (one earner), with 2 children earning $2 million. Of the nine examples, they have the highest income. The one who gains the most is the single guy (Jason) earning $52,000. Of course, if single guy Jason had some children and a wife, he’d be getting EITC and the government would be paying him a bonus of about $6,000. But only tax payers are covered in this example of 9 households, not the 49% who don’t pay any federal income tax. https://taxfoundation.org/tax-cut-senate-tax-cuts-and-jobs-act/

Democrats of course will point out the gap between $52,000 and $2,000,000 not the change in what each household pays.