From: Overview of the Federal Tax System, 2018, p. 15 Congressional Research Service, March 29, 2018

“Payroll taxes are used to fund specific programs, largely Social Security and Medicare. Social Security and Medicare taxes are generally paid at a combined rate of 15.3% of wages, with 7.65% being paid by the employee and employer alike.

The Social Security part of the tax, or the old age, survivors, and disability insurance (OASDI) tax, is 6.2% for both employees and employers (12.4% in total). In 2018, the tax applies to the first $128,400 in wages. This wage base is adjusted annually for inflation.

The Medicare portion of the tax, or the Medicare hospital insurance (HI) tax, is 1.45% for both employees and employers (2.9% in total). There is no wage cap for the HI tax (the Medicare HI tax applies to all wage earnings). Certain higher-income taxpayers may be subject to an additional HI tax of 0.9%. For married taxpayers filing jointly, combined wages above $250,000 are subject to the additional 0.9% HI tax. The threshold for single and head of household filers is $200,000. These threshold amounts are not indexed for inflation.

Employers may also be subject to a federal unemployment insurance payroll tax. This tax is 0.6% on the first $7,000 of wages. Federal unemployment insurance payroll taxes are used to pay for the administrative costs of the unemployment insurance (UI) program. State UI taxes generally pay for UI benefits.

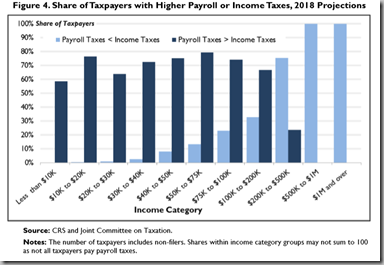

Most taxpayers pay more in payroll taxes than income taxes. The JCT [Joint Committee on Taxes] projects that in 2018, 67% of tax units will pay more in payroll taxes than income taxes. Most low- and middle-income taxpayers pay more in payroll taxes than in income taxes. [They pay zero income tax because of our progressive tax system.] Nearly all taxpayers with incomes of $30,000 or less pay more in payroll taxes than income taxes. Up through the $100,000 to $200,000 income category, the share of taxpayers paying more in payroll taxes than income taxes exceeds the share of taxpayers paying more in income taxes than payroll taxes.”

No comments:

Post a Comment