Signed into law by President Biden in January 2025, the Social Security Fairness Act requires the agency to adjust benefits for 3.2 million people, including future and past benefits. Social Security has completed 90% of its caseload, according to its May 27 update. "

Thursday, June 05, 2025

A shocker came through the mail slot today

Signed into law by President Biden in January 2025, the Social Security Fairness Act requires the agency to adjust benefits for 3.2 million people, including future and past benefits. Social Security has completed 90% of its caseload, according to its May 27 update. "

Monday, January 06, 2025

New Year's changes in Social Security benefits for retirees

https://www.ssa.gov/pubs/EN-05-10045.pdf?

https://www.ssa.gov/policy/docs/program-explainers/windfall-elimination-provision.html?

Sunday, April 07, 2024

California's minimum wage trick by Democrats--virtue signaling

Minimum wage was never intended to be a living wage. An increase has always hurt the poorest by raising prices and closing them out to the possibility of moving up. It began in the Great Depression and FDR hurt blacks and women the most who at that time could compete for jobs by using their negotiating for wages. This is more smoke and mirrors by Democrats. What employer would take a chance on an 18 year old with no skills but potential? Some kids don't even know how to show up on time--it's part of learning/teaching your minimum wage staff. Very few employed people earn minimum--it was already too high. Employers forced to pay $10-$15 will look for people worth it. California has hurt the poor and particularly American born minorities (immigrants often have a better work ethic if they walked 1,000 miles to get here).

Only about 1.4% of wage earners make federal minimum, compared to 13.4% in 1979. And that's not good. Those are earning/learning jobs--part time, good for teens and the mentally challenged that require good mentoring to move to the next level. Those jobs are now done by machines who won't take smoke breaks, call in sick, or want off for a relative's funeral. The good paying, living wage jobs are the kids who went to trade school, or high school grads who can be carpenter or plumber helpers.

Some are saying then an increase is needed for Social Securty. For that we have COLA. Like Minimum wage, Social Security was never meant to be a living wage. Rate of return in 2022 was about 6%--and considering a dicey economy struggling with socialist Bidenomics, that's not bad. It was about 1.2% in the late 90s. Possibly private investing could do better, but SS has a number of other programs to help workers that pensions and 401-k's don't. Unfortunately, we are now down to about 2.9 workers for every retiree. In 1940, that was 42. Someone in FDR's cabinet couldn't do the math. But that's Democrats. Promises, promises.

Saturday, June 11, 2022

There is a tomorrow, and someone has to pay for it

This is an informative article. If you're looking at retirement with SS benefits to supplement your pension in 10-15 years, you definitely should be paying attention. I have a state teacher's pension so I don't get SS (that would be double-dipping). Did you know that? Nor am I be eligible for spousal benefit if my husband died first. G.W. Bush had planned to work on fixing this but with 9-11 and the war he got sidetracked and I don't think any president since then has even mentioned it. Now with raging inflation, you may need to adjust your spending and saving.

Sunday, May 16, 2021

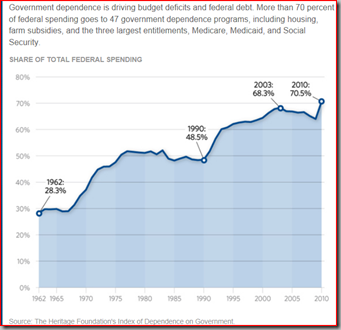

Non-defense spending

Six charts illustrating what is happening to non-defense spending/safety net. 6 Charts Highlight Trends Driven by Growing Nondefense Spending (dailysignal.com)

The growth of the federal budget and the debt has been driven by an unsustainable growth in nondefense spending.These charts illustrate how we got here and the long-term consequences to our nation’s financial health.

Friday, February 01, 2019

The Middle Class Yarn spun to frighten you

It's not exactly fake news, but it's misleading--the story you hear that the middle class is shrinking and so many more people are using government benefits because of the gap between the very wealthy and the "others." There are three things to consider:

1) demographics/age,

2) marriage or the lack of it, and

3) expansion of federal benefits from the poor and deserving to the middle class.

Rejoice, patriots. It's not true. The middle class is only shrinking because so many people have moved up to the next quintile! Have you ever driven to the suburban areas of Columbus (or the city where you live)--I can't believe the homes, schools, shopping centers, churches, gyms, parts, etc. And the new high rise housing in the central city for all those millennials willing to pay the apartment costs.

Also, as the boomers retire, they are now living on their pensions and investments (the very wealth Elizabeth Warren wants to go after), plus they are drawing Social Security. And guess what, a two parent household with both adults working has a much higher income than a one parent household who is most likely a woman. Two adults in a home have more time to distribute to the children to see to it they are educated and well-fed. It's amazing how many "experts" in socialist think tanks switch to "household" to show poverty rates and don't factor in $30,000 in transferred benefits like EITC, SNAP and Section 8.

We've been in 4 of the 5 quintiles in our 58 years together, as have many our age. We have 5 streams of income, as do many our age--some if they have military benefits have 6 or 7. We're certainly not suffering, but as retirees, we have less INCOME than when we were DINKs, but more WEALTH because we have lived frugally and invested or lived on one income. Warren wants to punish us for living on less when we were in our 40s.

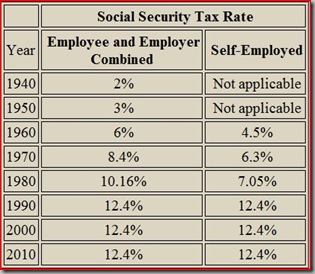

Left of center think tanks crunch the numbers and in horror say, the sky if falling. There's a gap that wasn't there in 1979. We need a more "progressive" system--higher taxes. Well, duh. You mean when we lived in an upper middle class neighborhood of the 70s in a home with 1.5 bathrooms, 2 TVs, 1 phone, 1 car, 1 income, and lived month to month with 2 growing children in our home? Do you mean when we had 1 week vacation, which we spent at Mom's farm, and paid our own health insurance? Do you mean when we had a mortgage and a car payment, but no credit card or college debt (never had that because we never borrowed). Do you mean when FICA withdrawals from our 1 check ended at $22,900 and there was no Medicare tax (now is $127,200 FICA + 1.45% for Medicare)? And the personal exemption? Much higher then. Don't have the exact figure for 1979, but if the 1913 rate (year of modern income tax) of $3000 were adjusted for inflation it would be about $72,000--anyone getting that?

So what has the government done for the poor and low income with all the tax money and safety net money we've sent in the last 40 years? Well, the so-called safety net expanded so much that the middle class now qualifies for many entitlement programs meant for the poor. The middle class voter now screams if there's no COLA for Social Security (which originally was for the poor widows and orphans) and Medicare.

Now 55% of the U.S. population are receiving some sort of entitlement--and it's not because we're poor, it's because we're middle class and wealthy. It's because for every election the politicians dangle an increase for the population served by Social Security, or one of our 5 health insurance programs. Government programs NEVER get smaller--they always expand, and since there are so few poor people in America, they expand into the middle class. There are people earning over $100,000 who qualify for government benefits--even Obamacare.

Monday, January 14, 2019

Social Insurance and Retirement Payroll Taxes

From: Overview of the Federal Tax System, 2018, p. 15 Congressional Research Service, March 29, 2018

“Payroll taxes are used to fund specific programs, largely Social Security and Medicare. Social Security and Medicare taxes are generally paid at a combined rate of 15.3% of wages, with 7.65% being paid by the employee and employer alike.

The Social Security part of the tax, or the old age, survivors, and disability insurance (OASDI) tax, is 6.2% for both employees and employers (12.4% in total). In 2018, the tax applies to the first $128,400 in wages. This wage base is adjusted annually for inflation.

The Medicare portion of the tax, or the Medicare hospital insurance (HI) tax, is 1.45% for both employees and employers (2.9% in total). There is no wage cap for the HI tax (the Medicare HI tax applies to all wage earnings). Certain higher-income taxpayers may be subject to an additional HI tax of 0.9%. For married taxpayers filing jointly, combined wages above $250,000 are subject to the additional 0.9% HI tax. The threshold for single and head of household filers is $200,000. These threshold amounts are not indexed for inflation.

Employers may also be subject to a federal unemployment insurance payroll tax. This tax is 0.6% on the first $7,000 of wages. Federal unemployment insurance payroll taxes are used to pay for the administrative costs of the unemployment insurance (UI) program. State UI taxes generally pay for UI benefits.

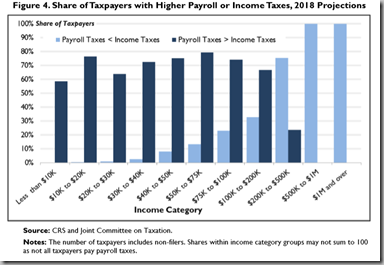

Most taxpayers pay more in payroll taxes than income taxes. The JCT [Joint Committee on Taxes] projects that in 2018, 67% of tax units will pay more in payroll taxes than income taxes. Most low- and middle-income taxpayers pay more in payroll taxes than in income taxes. [They pay zero income tax because of our progressive tax system.] Nearly all taxpayers with incomes of $30,000 or less pay more in payroll taxes than income taxes. Up through the $100,000 to $200,000 income category, the share of taxpayers paying more in payroll taxes than income taxes exceeds the share of taxpayers paying more in income taxes than payroll taxes.”

Saturday, June 30, 2018

Drain the swamp

"The Committee on the Budget in the Senate identified 83 overlapping federal welfare programs that together represented the single largest budget item in 2011 — more than the nation spends on Social Security, Medicare, or national defense. The total amount spent on these 83 federal welfare programs amounts to roughly $1.03 trillion. In inflation-adjusted dollars, the amount expended on just 10 of the largest of these programs has increased by 378 percent over the last 30 years. “

That's why a good job is the best program for the poor and low income, not another government program to fatten the bureaucracy. The Trump economy has done more for minorities and poor than guilt and smears the left can throw.

https://www.budget.senate.gov/imo/media/doc/CRS%20Report%20-%20Welfare%20Spending%20The%20Largest%20Item%20In%20The%20Federal%20Budget.pdf

Friday, January 01, 2016

Make your New Year's Resolution about your finances

According to the work of Harvard University's Malcolm Sparrow, fraud could account for as much as 20 percent of total federal health care spending, which would be considerably higher than what the government's figures indicate.

Wednesday, March 11, 2015

These are the people many want to give more power

Where do we get these data managers who work for the federal government? Are they like school children who get passed along to the next grade level, only for step increases? Maybe we should hire some known hackers to straighten it out. Millions of Social Security card holders don’t exist—or if they do they are using someone else’s record.

The review found that one individual opened bank accounts using Social Security numbers for individuals born in 1869 and 1893.

The official database of active Social Security numbers showed that both beneficiaries were alive, meaning they would be older than 145 and 121 years, respectively.

Wednesday, December 18, 2013

Progressives on Social Security

There are so many holes in this testimony about Social Security it is hard to know where to poke. GW Bush wanted to reform SS by creating private accounts, but the "progressives" screamed. It would have meant we actually owned and controlled and passed along our investment--taking it out of government hands, an anathema to the left.

Saturday, November 02, 2013

Transfer of wealth

Just heard a Social Security defender on Fox News say that for every $1 in benefits, Social Security payments generate $2 in the economy. What about the two workers paying in for every retiree drawing Social Security? Some working for minimum wage at Wal-Mart or McDonald’s. How would they be spending that money taken from them? This is generational transfer from the young to the old, not drawing on an investment or "trust fund.”

Both the working poor and the upper income rich have their wealth transferred to the middle class, the group that is the beneficiary directly and indirectly of most government policies and taxes, many for the misnamed War on Poverty, (but Social Security is probably the oldest and best example). According to the catalog of federal domestic assistance, there are 2,199 Federal assistance programs and most benefit the middle class either directly, or by employment. HHS has 19 offices and 461 programs; each with its own bureaucracy. Please don't blame Obama for this, or any political party.

Does the federal government really need "To maintain and expand existing markets for dairy which are vital to the welfare of milk producers in the United States." We still have "separate but equal" when it comes to Indians and anyone who is 1/4 Indian, with federal grants galore, including Tribal Colleges and Universities. For 50 years the federal government has been funding "conciliation and mediation services" to local groups to reduce "tensions, conflicts, and civil disorders arising from actions, policies, and practices that are perceived to be based on race, ethnicity, or national origin." Imagine the community organizers who live well on that one! And yet 93% of murdered blacks are killed by other blacks, mostly young with no racial or ethnicity motives.

A tiny percentage of federal grant money goes to the poor; most goes to the middle class in the form of jobs, contracts, conferences, travel, research grants, academic salaries, indirect costs to the institution for utilities, staff, overhead (can be as high as 60% of the grant) and that doesn't even include the buildings that are required and the trades and unions who benefit. One Appalachian grant I read through (about $76,000,000 a year) supposedly was training 20,000 students a year; it’s been going on since 1965—why aren’t they all successful and free of poverty at that rate? Because the money goes to the teachers, social workers, facilities, grant writers, conferences, etc.

I should know--I've made a very nice middle class living on special government contracts funneled through Ohio State or the state of Ohio. I have been employed on USAID funds, FIPSE money, JTPA, Department of Aging of Ohio; I have published research funded by the state and federal government, which was then purchased by the institutions for which I worked, which were funded in part by the government; I have done some very nice travelling on your dime—Washington, DC, San Antonio, Kansas City, Seattle, Detroit and Chicago. I also have a teacher's pension which pays far better than Social Security which non-government workers get. Don’t get me wrong--I worked hard, and you got your tax dollar’s worth, however, few poor people were lifted out of poverty. Primarily the middle class benefited, including me. Go to this website and type "library" or even something more exotic, like fashion or travel, into the search window. https://www.cfda.gov/

Thursday, October 31, 2013

Social Security compared to Affordable Care Act

Substitute a few words, and it's a good description of ACA in our era. "We find it hard to conceive of a greater triumph of imaginative packaging than the combination of an unacceptable tax and an unacceptable benefit program into a [health insurance] Social Security program that is widely regarded as one of the greatest achievements of [Obama's first term] the New Deal." Milton Friedman, Free to Choose, 1980.

Just in case you think Social Securty actually is a good deal, remember no one can subsist on the benefit it provides, which I think is maxed at about $28,500. It takes 2 workers paying in today to support one retiree (there were 17 in the 1950s, 42 in 1945), it's regressive--the low income workers are less likely to live long enough to collect what they paid in, spouses who never worked get the same amount as those who did, millions who paid in (like me) will get nothing because of another government pension, or die before collecting like my sister who began working at 14 and died at 57, and won't be able to pass it along to their children.

Yes, it is a wealth transfer program--from the young to the old. From the poor and the rich to the middle class. Another similarity to the Affordable Care Act.

Saturday, February 16, 2013

Sequestration, or where are the cuts?

Most of our tax money (70%) goes for social programs, especially Medicare, Medicaid, VA, and Social Security. Some conservatives don’t like Social Security and Medicare called an “entitlement,” but they truly are—we should be entitled to what we paid in with interest. (I’m not because I have a teacher’s pension and get nothing for what I paid in to SS in non-government jobs, nor a spousal benefit.) And it isn't the fault of Obama, as some detractors claim (he's got more than enough problems without giving him that one.) That will only increase.

The defense budget is extremely small, although the sequestration was Obama's idea (now trying to blame GOP) and is a rather small amount, it will certainly hurt the thousands of civilian employees right now as other lower paid jobs become unavailable because of raising the minimum wage—which always hurts the economy. It's a wonderful 2-fer for the president to hurt the economy even more which seems to be his major desire as he flits from gay marriage to stomping out freedom of religion to passing out free contraceptives instead of freeing up businesses to create more wealth.

The federal government should have stayed out of education--it wastes a lot of that money, and that responsibility was left to the states. Head Start, one of the biggest federal wastes with a 40 year history of failure, will probably get money better spent on bridges and roads, that he never gets around to that despite his promises. http://blog.heritage.org/2012/09/23/chart-of-the-week-70-of-spending-goes-to-dependence-programs/

Thursday, January 10, 2013

Let’s save Social Security and Medicare by raising the age of eligibility

Social Security was designed for a nation with a life expectancy in the 60s. The plan was that not many would ever get what they were taxed for. Now it has increased by about 60% or about 30 years. But the years after 85 have also increased. If we want to save the safety net that many poor and low income rely on, the retirement age needs to be raised, as well as the Medicare age.

http://www.elderweb.com/book/appendix/1900-2000-changes-life-expectancy-united-states

Friday, January 04, 2013

Promises, promises—your Social Security

At the outset of the Social Security program (law was passed in 1935), the federal government published an informational pamphlet that stated the following about Social Security taxes: "And finally, beginning in 1949, 12 years from now, you and your employer will each pay 3 cents on each dollar you earn, up to $3,000 a year. That is the most you will ever pay."

Social Security is a better program for the poor than the middle class.

"A person who earns $15,000/year will pay $86,000 in payroll taxes (employer and employee combined) over 44 years of work. When he retires, his annual benefit will be $10,128 or 11.8% of his lifetime payroll taxes. But a person who earns $110,000/year will pay $627,000 in payroll taxes over 44 years of work. When he retires, his annual benefit will be $31,260/year or 5.0% of his lifetime payroll taxes."

Most of us today would be thrilled to get almost 12% on our retirement accounts. The down side is you can't pass it along to your survivors like a private account.

Wednesday, November 28, 2012

The Fiscal Cliff

Let Obama take us over the Fiscal Cliff (he's out campaigning for tax increases right now) so people know what he's about. Of course, he will blame the Republicans who want cuts in spending to reduce the debt, but his proposed tax increase which he thinks you voted for will only pay for the government about a week. That’s useless and he knows it. The purpose was to create class resentment, not revenue. Then he'll have to come after YOUR paycheck.

One of the easiest and most sensible cuts is to raise the age of receiving Social Security and Medicare. It can be gradual so people have plenty of time to prepare. And which party has shot down that idea consistently—the Democrats. They want nothing to do with a program that will take power away from the government and put it in the hands of the citizen.

In 1930 the life expectancy for whites was 61.4 and blacks 49.2. Sixty-five for retirement (in an era when many worked their entire life) seemed extremely optimistic. But in 2010 for whites it is 79 and for blacks 75.1. A male retiree, born in 1940, will spend anywhere from 19 percent to 25 percent of his life collecting Social Security benefits (depending on whether he retired at the normal retirement age of 65 or chose early retirement), and a female born in the same year will spend 21 percent to 27 percent of her life collecting benefits.

The biggest old age problem we have is not Social Security, but a less than replacement birth rate, and many people will have no cousins and no nieces or nephews as well as no grandchildren to help them. Families are the original safety net, but the Democrats by pushing contraception and abortion are also weakening this safety net. Maybe YOU have grandchildren, but will they have grandchildren?

http://www.infoplease.com/ipa/A0005148.html

Obama has no intention of saving the United States from its plunge into being Greece or a failed European state. So don’t look for solutions—just look for higher taxes.

Thursday, April 26, 2012

Where does the money go?

In 2010, the federal government spent 61% of its finances on housing and community services, welfare and social services, recreation and culture, health, education, retirement benefits, disability benefits and unemployment benefits. This amounts to 2,124 billion dollars or $19,316/household. "Government Current Expenditures by Function, Table 3.16." U.S. Department of Commerce, Bureau of Economic Analysis. Sept. 14, 2011.

http://www.justfacts.com/socialspending.basics.asp

Modest changes won’t solve Social Security

“In 2011, the Old-Age and Survivors Trust Fund, which pays for retirement and survivors’ benefits, took in $698.8 billion, which includes $106.5 billion that came from a paper transaction that credited interest to the trust fund. Excluding the interest, the retirement and survivors program had income of $592.3 billion but paid out $603.8 billion in benefits, leaving a deficit for 2011 of $11.5 billion. Additional deficits were suffered by Social Security’s disability program.

Counting both programs together, in 2011, Social Security spent $45 billion more in benefits than it took in from its payroll tax. This deficit is in addition to a $49 billion gap in 2010 and an expected average annual gap of about $66 billion between 2012 and 2018. These deficits will quickly balloon to alarming proportions. After adjusting for inflation, annual deficits will reach $95 billion in 2020 and $318.7 billion in 2030 before the trust fund runs out in 2033. Now is the time to focus on solutions.”

Monday, May 23, 2011

Comparing Social Security with private investment for retirement

One of the better and easy to understand explanations I've seen. Especially that 100% death tax.

![526720_10152342907500019_1754002925_n[1] 526720_10152342907500019_1754002925_n[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhKWl-IwAA1wJIJZk_SojDKPcslKM4YnUwxrnWzoSUrqcQPja0ShML5dIoiuOx6pjmQzs4BCUJFg7M9dLmVN94tutwxMb0g63XSWl5EB7ZhCRElDgbiql2m7PRkb0WoQC60XIw0Xw/?imgmax=800)