It's not exactly fake news, but it's misleading--the story you hear that the middle class is shrinking and so many more people are using government benefits because of the gap between the very wealthy and the "others." There are three things to consider:

1) demographics/age,

2) marriage or the lack of it, and

3) expansion of federal benefits from the poor and deserving to the middle class.

Rejoice, patriots. It's not true. The middle class is only shrinking because so many people have moved up to the next quintile! Have you ever driven to the suburban areas of Columbus (or the city where you live)--I can't believe the homes, schools, shopping centers, churches, gyms, parts, etc. And the new high rise housing in the central city for all those millennials willing to pay the apartment costs.

Also, as the boomers retire, they are now living on their pensions and investments (the very wealth Elizabeth Warren wants to go after), plus they are drawing Social Security. And guess what, a two parent household with both adults working has a much higher income than a one parent household who is most likely a woman. Two adults in a home have more time to distribute to the children to see to it they are educated and well-fed. It's amazing how many "experts" in socialist think tanks switch to "household" to show poverty rates and don't factor in $30,000 in transferred benefits like EITC, SNAP and Section 8.

We've been in 4 of the 5 quintiles in our 58 years together, as have many our age. We have 5 streams of income, as do many our age--some if they have military benefits have 6 or 7. We're certainly not suffering, but as retirees, we have less INCOME than when we were DINKs, but more WEALTH because we have lived frugally and invested or lived on one income. Warren wants to punish us for living on less when we were in our 40s.

Left of center think tanks crunch the numbers and in horror say, the sky if falling. There's a gap that wasn't there in 1979. We need a more "progressive" system--higher taxes. Well, duh. You mean when we lived in an upper middle class neighborhood of the 70s in a home with 1.5 bathrooms, 2 TVs, 1 phone, 1 car, 1 income, and lived month to month with 2 growing children in our home? Do you mean when we had 1 week vacation, which we spent at Mom's farm, and paid our own health insurance? Do you mean when we had a mortgage and a car payment, but no credit card or college debt (never had that because we never borrowed). Do you mean when FICA withdrawals from our 1 check ended at $22,900 and there was no Medicare tax (now is $127,200 FICA + 1.45% for Medicare)? And the personal exemption? Much higher then. Don't have the exact figure for 1979, but if the 1913 rate (year of modern income tax) of $3000 were adjusted for inflation it would be about $72,000--anyone getting that?

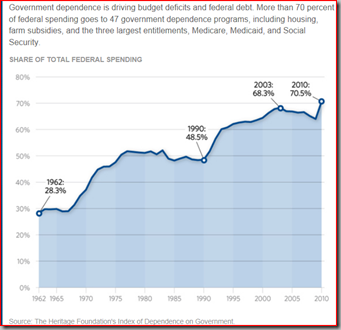

So what has the government done for the poor and low income with all the tax money and safety net money we've sent in the last 40 years? Well, the so-called safety net expanded so much that the middle class now qualifies for many entitlement programs meant for the poor. The middle class voter now screams if there's no COLA for Social Security (which originally was for the poor widows and orphans) and Medicare.

Now 55% of the U.S. population are receiving some sort of entitlement--and it's not because we're poor, it's because we're middle class and wealthy. It's because for every election the politicians dangle an increase for the population served by Social Security, or one of our 5 health insurance programs. Government programs NEVER get smaller--they always expand, and since there are so few poor people in America, they expand into the middle class. There are people earning over $100,000 who qualify for government benefits--even Obamacare.