Financial scare stories

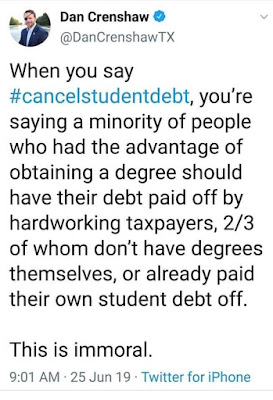

When someone like Michelle Obama whines about being required to pay back the cost of her Ivy League education which has landed her a darn good paycheck on a non-profit board, I want to ask why she didn't just go to a state college or university. She still could have been a 2-fer and gotten special grants and loans but would have had much less to pay off.

USAToday ran an article last week on a 49 year old living in a million dollar California home with at least 15 years left until her retirement whining about her 401-K being down 4% and the dropping real estate values in her Redlands, CA neighborhood. Today it's a 30 year old married

Bryan Short, merger and acquisitions lawyer scraping by required to pay back the college loans that got him this great job in one of the most expensive cities in the country. Do these journalists (who probably are free-lancers and making a fraction of the income of these whiners) ever want to kick them in the knee? Surely they didn't go looking for these stories!!

But the biggest lie in these financial stories is that Gen-X (1965-1980) and Gen-Y folks won't ever do as well as their parents. This is always quoted from left of center think tanks who testify before Congress on why there needs to be more government assistance. That's nonsense. All they have to do is live the way we did when we were in our 30s. Then a middle class standard of living was much simpler than today. Smaller homes, fewer cars, fewer toys. We had no cable bills, no broad band, no gaming devices, no cell phone bills and if we went out to eat it was on Sunday morning for eggs and toast, or Friday night for a pizza. We vacationed at my mother's farm one week and used the other week (after he got 2) to fix up the house. At our house we had one car and Mom stayed home, so there were no child care bills. If Bryan and his wife tried living at the very comfortable standard of living we had 35 years ago, they might be surprised how quickly they'd whittle down those college loans and credit card bills.

And that household income these journalists report? A lot of us in the 1960s and 1970s, if we were white collar workers, purchased our own life and health insurance with after tax income, had minimal if any benefits for vacation and sick leave, and had no retirement plan at all. Benefits were for factory workers and union members. And why they think it's better that a company, which could go under or be merged, hold on to the employee's pension rather than her owning a self-directed 401-k or 403-b is a mystery to me.

Oh yes, Ms. O'Shaughnessy, you forgot to mention that in the 1960s and 1970s, hardly anyone except celebrities and hippies lived together before marriage, and we also got married younger with fewer years to rack up bills traveling the world and having a blast. Most of us didn't have college loans to pay back because we didn't borrow money to live grandly while in college.

See also:

The burden of student loansThe working familyMaterial well being of AmericansHow to spend your way into foreclosureMy story doesn't sell newspapersSix figure incomes--I feel their painYoung people in debt

![1002464_10153420609060515_1779416598_n[1] 1002464_10153420609060515_1779416598_n[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgMnpPms-NXyc0mcNw3s70wveo1Y6Ilp1l9dzx1bISzqyw9THZ3zYKjJf5IlMnHUcUFpOT-6oMi3dYDiL5wNlyajK6RAs9MOpjoP0CFS1rsDUaO9V4BnTQcrbUTqE-6NJGArg76ww/?imgmax=800)