"The unemployment rate in November 2019 was 3.5%, a level not seen since the 1960s."

". . . household incomes, which have rebounded in recent years."

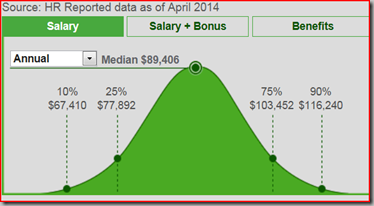

"In 2018, the median income of U.S. households stood at $74,600. This was 49% higher than its level in 1970, when the median income was $50,200." (Incomes are expressed in 2018 dollars.)

"On balance, there was more movement up the income ladder than down the income ladder. [since 1970]"

"Since 1980, incomes have increased faster for the most affluent families – those in the top 5% – than for families in the income strata below them." (If you look at the inflation adjusted charts, this doesn't seem to be so, but if wealth creates wealth and there's been a huge increase in dual income families in the last 40 years, I would agree. In the long run, wealth transfers from the government from the middle class to the lower class may help consumption, but it doesn't build wealth to be passed along by generations.)

Several paragraphs in the report note the rising incomes of the upper income, without noting the disparity in marriage rates. Obviously a three person household of a single mother and two children, is going to be less than a three person household of a married mother, father and child. Income gaps between white and Asian households can usually be adjusted for marriage and number of family members. Childhood poverty can almost all be explained by the difference in marriage rates.