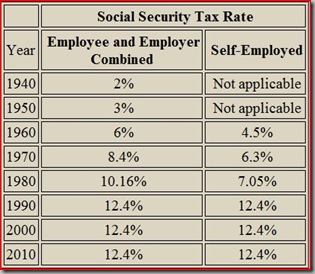

At the outset of the Social Security program (law was passed in 1935), the federal government published an informational pamphlet that stated the following about Social Security taxes: "And finally, beginning in 1949, 12 years from now, you and your employer will each pay 3 cents on each dollar you earn, up to $3,000 a year. That is the most you will ever pay."

Social Security is a better program for the poor than the middle class.

"A person who earns $15,000/year will pay $86,000 in payroll taxes (employer and employee combined) over 44 years of work. When he retires, his annual benefit will be $10,128 or 11.8% of his lifetime payroll taxes. But a person who earns $110,000/year will pay $627,000 in payroll taxes over 44 years of work. When he retires, his annual benefit will be $31,260/year or 5.0% of his lifetime payroll taxes."

Most of us today would be thrilled to get almost 12% on our retirement accounts. The down side is you can't pass it along to your survivors like a private account.

No comments:

Post a Comment