50 Important Welfare Statistics for 2023 | Lexington Law

There were 70 million people on the Social Security Administration (SSA)’s welfare programs in the United States in 2021 which includes SNAP, housing assistance, unemployment programs and Medicaid. It is higher than military spending. It is estimated welfare spending in 2023 will account for around 14 percent of the federal budget.Monday, October 02, 2023

Monday, May 23, 2022

How Biden's American Families Plan hurts the low income

Consider a household that receives benefits from only two welfare programs, with one tapering off at 20 cents for each added dollar earned and another tapering off at 40 cents for each added dollar earned. Those cuts create an implicit tax rate of 60 percent, which means the worker has only 40 cents in additional spendable income for each added dollar earned. This implicit tax rate can be expected to affect work incentives in much the same way that a federal income tax rate does.

To further illustrate, consider a real-life, low-income single mother of two children in Forsyth County, North Carolina earning $10 an hour in a full-time job, which means she has a monthly earned income of $1,600 (or $19,200 annually). Suppose the single mother receives monthly benefits from five welfare programs: $425 in food stamps, $1,471 in subsidized childcare, $370 in housing subsidies, $180 in WIC benefits, and $493 in an earned income tax credit (EITC). Her monthly welfare benefits will total $2,939 (or $35,271 a year).

Now, suppose the single mother takes a new job paying $15 an hour, a 50 percent increase. Her monthly earned income will rise by $800 to $2,400 (with her annual income rising to $28,800 a year, an annual earnings increase of $9,600). However, she will face decreases in four out of her five monthly benefit streams, with each benefit reduction based on the same $800-increase in earnings (a problem known among welfare researchers as the “cumulative stacked effect”). The single mother will lose $231 in food stamps, $80 in childcare benefits, $216 in housing benefits, and $166 in EITC. Her total decrease in monthly benefits will reach $694 (which means her annual benefit total will drop by $8,328).4 Her implicit tax rate on her added monthly earnings of $800 is 87 percent—more than two times the highest explicit marginal tax rate proposed for the rich. (The details of our calculations are in a table we have appended to the end of this article.)

In addition, the single mother will be required to pay an added $185 a month in federal and state income taxes on her added earned monthly income of $800, which is an explicit tax rate of 23 percent. Adding the 87 percent implicit tax rate to the 23 percent explicit tax rate leads to an overall tax rate of 110 percent. Her raise has left her $79 per month poorer in lost wages and benefits—surely a strong disincentive for her to take the higher paying job.5

But the total (implicit plus explicit) marginal tax rate on poor and low-income workers can be worse, and actually spikes to 1,400 percent at an earned income of around $43,000 (which is known as the “welfare cliff”).6 However, studies in different areas of the country show that the total marginal tax rate on poor and low-income workers within an annual earned-income range of $15,000 to $80,000 moves between 28 and 53 percent for full-time workers earning up to an annual earnings of $24,000 (or $12.50 an hour). The implicit tax rate for workers earning between $24,000 and $40,000 jumps to 90 percent.7"

Wednesday, June 12, 2019

Do native born Americans use more welfare at a higher rate than illegal immigrants?

Have you ever wondered where some anti-Trumpers and Leftists come up with their "native born Americans use more welfare than illegals" memes and mottoes? Just read such an article today by a very sound research organization, Cato, which is libertarian. "Immigration and the welfare state: immigrant and native use rates and benefit levels for means-tested welfare and entitlement programs." Alex Nowrasteh and Robert Orr, May 10, 2018.

Here's the reasoning. First of all, toss in Social Security, SSI and Medicare into the pot and call that welfare. I know more than a few Americans who would object to calling the retirement plan and insurance they paid for "welfare."

Second, don't distinguish among green card holders, permanent residents, temporary workers, students (F-1, F-2, F-3 visas) refugees and naturalized citizens and illegal border crashers from 84 countries pouring through our southern border. It wouldn't shock me too much if green card computer employees of Google, Amazon and Microsoft from India and China earning 3x the wage of the average American don't use welfare. Just chatted with a 20-something recent OSU graduate (probably Indian, but could be Pakistani) on my walk yesterday, ready to take off for Seattle to work. From student visa to work visa (H1b).

Third, neglect to point out that virtually all the in-kind benefits that come from the 50 states, originate at the federal level--the National School Lunch Program, WIC, Head Start. Since those are available to all regardless of immigration status, that's also on the wrong side of the ledger.

Fourth, ignore that no one actually has a figure on how many illegals are living among us, working 2-3 jobs, being paid under the table, and sending remittances home to Ecuador or Honduras or Kenya. The churches and non-profits who receive government grants do not ask questions--they serve all.

Table 1 in the article disproves Cato's thesis by using what most Americans would define as federal "welfare." Percentage using Cash assistance, 0.7 by natives, 0.8 by noncitizens; SNAP 9.6 by natives, 14.6 by non-citizens; Medicaid 12.3 by natives, 18.9 by non-citizens.

The article is really loosey-goosey when it comes to the children. It has a category for "child immigrants" (which could be children of green card holders, work visa holders, naturalized citizens, temporary workers) and for "citizen children of noncitizen parents." Duh! I'm not too shocked if the immigrant child of a Filipino computer programmer working for Google is less likely to be using welfare than the child of a coal miner in West Virginia whose parents lost their jobs because of a clean air regulation.

It's not fake news, just government statistics with no agreement on terms.

Friday, June 07, 2019

How the Census over counts poverty

Are you surprised if our borders are flooded with illegals who ignore our laws? They know the Democrats will protect them, pay for college, let them vote, not require citizenship, and even supply pro-bono lawyers for crimes, and it must look like the streets are paved with gold for the poor.

In the United States, in 2015, there were 43.1 million people the Census said were living in poverty (a very misleading figure).

Poor households routinely report spending $2.40 for every $1 of income the Census says they have. (Some figures are from 2009 even though article is 2016) https://www.dailysignal.com/2016/09/13/15-facts-about-poverty-in-us-government-buries/

"The average poor American lives in a house or apartment that is in good repair and has more living space than the average nonpoor person in France, Germany, or England.

Eighty-five percent of poor households have air conditioning.

Nearly three-fourths of poor households have a car or truck, and 31 percent have two or more cars or trucks.

Nearly two-thirds of poor households have cable or satellite TV.

Half have a personal computer; 43 percent have internet access.

Two-thirds have at least one DVD player.

More than half of poor families with children have a video game system, such as an Xbox or PlayStation.

One-third have a wide-screen plasma or LCD TV." . . .

"In 2014, government spent over $1 trillion on means-tested welfare for poor and low income people. (This figure does not include Social Security or Medicare.) Welfare spending on cash, food, and housing was $342 billion.

The cash, food, and housing spending alone was 150 percent of the amount needed to eliminate all poverty in the U.S. But the Census ignored more than four-fifths of these benefits for purposes of measuring poverty. Effectively, the Census counts poverty in the U.S. by ignoring almost the entire welfare state."

Friday, March 29, 2019

What is the role of non-profits?

The Special Olympics is in the news right now. Betsy DeVos suggested budget cuts, and since it isn’t a government agency, she recommended cutting the $15 million it gets from the federal government. I didn’t know they got any—but I should have. It’s a worthy organization, doing a lot of good, and we contribute. For the last 50 years, the federal government has been “bullying” the non-profits, while also providing a large part of their funding.

"Until recently, our understanding of the development of the welfare state in advanced industrial countries assumed that the hallmark of a progressive welfare state was a large public sector that regulated the private sector to a small residual role. In this view, the United States with its smaller public sector and larger private nonprofit sector compared unfavorably. The government contracting with nonprofit agencies calls the prevailing view into question. In the recent period, government has used nonprofit agencies to expand the boundaries of the welfare state in the United States in a host of service categories - from child abuse to domestic violence to homelessness. The result is a welfare state that is more expansive than would be the case if policy makers relied solely on the public sector." Political Science Quarterly, vol 104, no.4 1989-90.

This article is 30 years old, but the points still hold true--except for that part that non-profits don't have the bloated salaries of government workers. It wouldn't surprise me if the non-profit heads aren't making more than comparable level of government employees.

There is a revolving door in DC for one party's pooh-bahs to move to a non-profit when out of power, then be called back when they regain power. This really ballooned under GHW Bush--"Thousand points of Light."

Tuesday, March 05, 2019

From the inside—how she escaped the welfare trap

Tinker writes on Facebook:

“I have been a life long conservative (not to be confused as a Republican) because of how I watched the “system” take advantage of my mother’s propensity toward drugs, alcohol and terrible men. She had 5 children from 3 men (not husbands) and fed her addictions more than she fed her children. She would bring her destructive “love” relationships into the home and subject her kids to the inevitable destruction that was to be our “normal” way of living.

She was on every subsistence available to her, and learned how to game the system with precision. Welfare would occasionally call to schedule an appointment for a “welfare check” and with that handy little heads up, my mother would move her man’s clothes etc., out of the house so that it appeared to be just her, a poor pathetic abused woman, and her five hungry kids struggling to make ends meet. As a CHILD I saw that this was wrong and hopeless, but the checks kept coming . . .yet somehow life never got better.

My mom was never truly helped by any of these handouts, in fact quite the opposite. But more importantly, her children were absolutely never helped by this government “assistance “. It became a lifestyle, a career actually for my mother until the day she died at 39 due to a (rather short) lifetime of drug and alcohol abuse. She learned how to sell food stamps for cash, and work a waitressing job (for cash) while still collecting “government assistance “. And make no mistake, it’s a community. All of her friends were exactly the same, and all of their kids had the same look of despair as my mothers children.

I am so grateful, GRATEFUL that I somehow saw the reality of this cycle of abuse (and that’s what it is!) that was perpetrated on our family. I truly believe that the “system” saw all of us kids as future Democrats. I really do. I left home at 16, moved in with a friend and her family, finished high school and began building my own life. Happy in the struggle of it too because I knew I was free. Free from being held down by a system that promised to give me clothes and food if I would remain faithful to the system. No way!

Then for some reason, though my mother was anything but political, I was drawn to such things. In the 10th grade I was intrigued by Ronald Reagan. The media hated him, my teachers weren’t crazy about him and sometimes said the most awful things about him, but I just couldn’t believe these things were true of someone who had been elected by the people of America. My father had been in the army, my grandfather and uncle had served in the Air Force, so at heart, I was a patriot (I didn’t really know that term then), but I really loved America. So I began listening to Ronald Reagan, and then I wrote him a couple of letters. . . .and he wrote back! My first ability to vote was in his re-election, I was 19 and I couldn’t have been more proud to cast my vote for him.

My whole extended family (as I later learned) were blue blood Democrats, so I guess I defected from tradition without knowing it. We never openly discussed politics in my family. So, I can truly say that I have always been a conservative. Not because I was trained to be such, but because life’s struggles and lessons had shaped me in that direction, and I learned first hand the rewards of hard work. It just made sense to me.

I am also a woman who loves Jesus, I have since I was a very young girl. He is (quite literally) my Savior. I think it is SO IMPORTANT to know what you believe, and WHY you believe it. Because THAT is what makes us authentic, and real, right down to our soul. Our beliefs cannot simply be an “anthem” or some clever meme, they must reveal who we are and act as a compass, or we will crumble when the storms of life come blowing through, or fall for silver tongued politicians who say what our itching ears may want to hear.

Thank you Brandon [Walkaway campaign] for your courage, your honesty and most importantly, your willingness to use your life to help others in the struggle. Your interview with Mark Levin was captivating and raw and I found myself praying for you and thanking God for your strength and willingness to accept something that had been so contrary to your previous beliefs. Continue to shine your light of truth so that others can break free from the bonds of emotional entrapment which the Left has so skillfully kept them strapped to.

Wednesday, April 18, 2018

Where is she now? Uncle Sam's step daughter.

Waterbury wrote an opinion piece for the Wall Street Journal in August 1996 about his son--an industrious, hard-working young man who served more than 8 years in the Marines, but in civilian life he was working 2 full time jobs and had no health or life insurance, no pension or profit sharing plan, and survived week to week. His son had a daughter with his girl friend who had three other children. However, she couldn't marry the younger Waterbury, because she was already married to Uncle Sam who provided money, food stamps, medical and dental treatment. Legal marriage he wrote terminates welfare assistance, but absentee fathers and others may visit for purposes including sex. If his son's girlfriend got a job the welfare system would penalize her by reducing her benefits.

So grandpa was wondering how he could help his granddaughter escape the welfare system.

Thursday, January 18, 2018

California's poverty rate--highest in the nation

City Journal

Friday, December 02, 2016

America's safety net and Paul Krugman

Speaking of jobs, how does Krugman keep his? If he paid attention, he'd realize that the so called "safety net" has always been bi-partisan but has 80 overlapping programs causing graft and waste. (Obamacare which mandated purchase of insurance or jail and a fine was supported just by Democrats, and not even all of them.) Krugman should know that a job is always better than a government program. And Donald Trump has promised Americans they can keep their jobs. Perhaps it will be an empty promise like "keep your insurance," or "you can keep your doctor," but he's made a good start by promising tax relief to encourage American companies to come home.

The left keeps pouncing on "the white working class" which they've made synonymous with white supremacists even though exit polls show Trump only got about 1% more of the white vote than Romney did, whom the left portrayed as a rich elitist appealing only to the wealthy. Trump picked up the traditional Democrat stronghold in the so-called "rust belt" (ugly name, blue wall is better) which got no relief in 8 years of Obama whom they voted for--TWICE. Meanwhile, Mrs. Clinton lost a lot of the most liberal Democrats to spoiler Jill Stein. Plus, people don't like being called racist, homophobic and deplorable just because they want a good job. All the left promises is a bigger safety net, higher minimum wage, and retraining. That doesn't pay the mortgage or the college tuition for the kids.

A lot of the so called "safety net" programs benefit the middle class most. Welfare benefits going to single parents with incomes less than half of the poverty level have decreased by 35 percent over the 1983 to 2004 period, whereas benefits to single parents making almost twice the poverty level have increased by 80 percent.

“America’s safety net can sometimes entangle people in soul-crushing dependency. Our poverty programs do rescue many people, but other times they backfire.” Nickolas Kristof.

https://medium.com/2015-index-of-culture-and-opportunity/total-welfare-spending-63802c3b021b#.oh96ujy43

http://www.heritage.org/research/testimony/2012/05/examining-the-means-tested-welfare-state

Thursday, March 17, 2016

Lies by posters on Face Book

I wonder what the poster creator is calling public assistance--apparently not the ER of hospitals which have federal and state money to never turn away anyone, or public schools required by law to hire special teachers and meet federal guidelines, apparently not people--usually men--who are put out of work by wages being slashed for roofers, cooks, gardeners, carpenters, not churches and charitable institutions that provide food and medical care and housing, plus job training many with government grants, not ESL programs that are free but using government grants for personnel. The correct part is YES indeed they do work, send money home, and pay off the criminal coyotes who brought them up from Ecuador or Guatemala dropping them in NYC. And of course, trafficking in persons (either prostitution or labor) isn't welfare, but they are very vulnerable under threat of being exposed. Yes, the creator of this lie needs a bit more research.

Thursday, September 10, 2015

Happy No-Labor Day

“As Americans celebrated the Labor Day weekend, nearly 94 million people of working age actually had nothing to celebrate. That’s because they aren’t in the labor force. They’re not working and they’re not looking for a job. The latest Bureau of Labor Statistics reports that the labor force participation rate is now 62.6 percent, a 38 year low.”

“A mother with two children participating in seven common welfare programs would enjoy more income than what she would earn from a minimum-wage job in 35 states, even after accounting for the Earned Income Tax Credit and Child Tax Credit. In Connecticut, Hawaii, Massachusetts, New Jersey, New York, Rhode Island, Vermont, and the District of Columbia, welfare pays more than a $20-an-hour job. “

http://www.forbes.com/sites#/sites/johngoodman/2015/09/09/why-does-anyone-work/

Government aid is bi-partisan—Republicans vote for increases almost at the same level as Democrats. It means VOTES! But obviously it’s not best for the individual, the family or the country.

Wednesday, February 12, 2014

Wednesday, February 05, 2014

Actually, this whopper may not be that big

The trick word here is "expanded." For instance, under Bush SNAP eligibility was expanded, but Obama increased recruitment to the program. EITC, HEAP, TANF, Medicaid, SCHIP, disability, even Obama phones (phone assistance began under Reagan) etc. were all programs of other presidents. Lack of good jobs and reductions because of Obamacare has pushed more onto government benefits. What's new is people fleeing the workforce to apply for and get SS disability because he couldn't turn around the job situation.

What has expanded is the wait for veteran’s benefits. For welfare recipients, there is a 30 day wait to qualify for food stamps, or expedited, 7 days. Over 675,000 claims pending for veterans, 58% for over 125 days. Why are veterans required to wait? Haven't they already paid? Are the low income, unemployed a bigger voting block than disabled veterans?

Friday, January 31, 2014

The President is just wrong about the poor

Americans are not poor due to an income gap or rising income inequality—that rate has been fairly stable over the years (also the poverty stats don’t count all the 79 means tested programs).

Here's the research, Mr. President. It's behavior and choice. People aren't poor because others are rich.

"If you do these [four] things, it’s almost impossible to remain poor:

1. Finish high school,

2. Get a job,

3. Don’t have children until you get married.

Those who do these things have only a 2 percent probability of remaining in poverty and a 75 percent probability of joining the middle class." John Goodman

The only new idea the left seems to have is universal preschool. (They don’t know how to reform any existing programs, so why not throw money after one more?) But the more common tactic (e.g., Paul Krugman) is to use inequality as an excuse for enacting the traditional liberal agenda — deficit spending, minimum wage increase, more unemployment compensation. If you think any of that is going to solve the fundamental problem, I know a bridge in Brooklyn that is for sale.

Remember welfare reform of the mid-90s? Even a job, any job, reduces the poverty rate. Wealth transfer doesn’t solve poverty.

"The poverty rate among full time workers is 2.9 percent as compared with a poverty rate of 16.6 percent among those working less than full time and about 24 percent for those who don’t work. Unfortunately, the percentage of adult males working has been declining for decades. The work rate among young black males is below 50 percent. By contrast, when single mothers substantially increased their work rates in the mid-1990s, the poverty rate among mother-headed families reached its lowest level ever.. .

We already spend more than enough money on means-tested programs for poor and low-income people to bring them all out of poverty. There were about 46.5 million people in poverty in 2012, a year in which spending on means-tested programs was around $1 trillion. If that money were divided up among the poor, we could spend about $22,000 per person. For a single mother and two children, that would be over $65,000. The poverty level in 2013 for a mother and two children is less than $20,000. So this strategy would work, but giving so much money to young, able-bodied adults would not be tolerated by the public. Besides, if government gave this much cash to non-workers, many low-wage workers would quit work so they too could collect welfare.”

Ron Haskins, http://www.brookings.edu/.../19-war-on-poverty-what-went...

Friday, January 24, 2014

There are 79 means tested programs for the poor and low income

Lumped together they loosely comprise “welfare” in the jargon of the people, but that means jobs for government workers.

There are 79 means tested programs to help the poor and low income and about 49% of that is medical and most goes to children, disabled and elderly. Only 8% for able bodied, working age adults. So good luck at cutting anything. It's about $19,000 for EACH American counted as "poor" by the Census. About 6% of the budget is for those "welfare" type programs, and 4.8 % of GDP for social security (Medicare is going to pass SS in 2040). We've all paid into Social Security, Medicare, and worker’s compensation, so many people don't like the word "entitlement" for those, even though we are entitled to them through our contributions. http://www.heritage.org/.../examining-the-means-tested...

Tuesday, September 24, 2013

There are no “cuts”

Both liberals and conservatives have ideas about people on food stamps that need adjusting. If you volunteer at a food pantry you'll see another side. I've worked the Lutheran food pantry in Columbus (3 days of food usually run by churches in most communities) and found people dependent on government programs are very resourceful, and if they have a special diet, they request those items. They also "budget" to a degree and manage to make their food last all but 3 days so they can come to the pantry at the end of the month. They will also turn down food if their children don't like it, or are getting breakfast, lunch and snacks at school. And like the rest of us, they pick out what they like even if they know better. Most that I observed look like they wouldn't be able to hold a job--alcoholics, pot heads, mentally ill, small children at home, elderly, handicapped, low IQ, or no transportation. With other federal and state benefits, a person on welfare in Ohio "earns" about $12.60/hour or about what an entry level teacher would get; in Hawaii they would get the equivalent of about $29/hour. That's another reason they are not working. They don't have the skills to earn that much and with TANF, Medicaid, SNAP, WIC, section 8 housing, HEAP, etc. they are better off not to work.

This is not to say there aren’t people down on their luck or in between jobs who need occasional help, but that’s rarely the regulars I see at the pantry. When a carpenter or stock broker loses his job and the mortgage is upside down or they’ve been through foreclosure, they need help too.

Friday, September 13, 2013

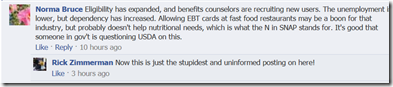

Why you can’t reason with ignorance

I contribute to Huffington Post political FB page. I don’t call people names, slander the president or make biased statements. I just contribute sourced statements. Like this one about why the food stamp program is expanding as unemployment drops and so mean old Republicans want poor people to starve by cutting back. All you have to do is check a reasonable source like the USDA or a non-profit that works with the poor—left or right—and you see that recruiting of low income people was expanded with ARRA money--the money that was going to get people back to work in 2009 was used in part to add more people to SNAP (the new name for food stamps). I even pointed out that the N in SNAP stands for nutrition, and that EBT cards can be used at fast food restaurants. For that easily researched information I was told I was stupid and uninformed. My posts are always researched and reasonable, and the left calls me a troll, stupid, tea bagger, racist, homophobe, etc. That’s the level of political discourse.

Wednesday, June 05, 2013

Star Parker has the CURE for dependency

It's possible you've seen Star Parker on CNN, TBN, CSPAN, CBN, and FOX News, and once you learned she's a conservative Christian, perhaps you picked up the remote and looked for someone else to discuss the news of the day. But if you're a Democrat, you should also know she's had several abortions and been on welfare so she knows your side of the fence too, even if she jumped it and ran to the freedom of Christ, because that's who changed her life. Today she's head of CURE, the Center for Urban Renewal and Education, a 501(c)(3) non-profit think tank which promotes market based public policy to fight poverty.

I wonder if the IRS has investigated her status--after all, she did leave the system for a better plan and tells others how to do it. That could be a threat to the current administration.

Saturday, March 02, 2013

How to keep people poor and bankrupt the middle class

According to the Congressional Budget Office (CBO) in a report on February 11, about one-sixth of federal spending went to “means-tested welfare” in 2011 through 10 major programs. Medicaid is the biggest chunk, and the second-largest is the food stamp program.

Eligibility for these programs has expanded as has the generosity of the benefits. They are a disincentive both to work harder or smarter or advance, and a disincentive for marriage, so they have probably hurt women and children the most.

Thursday, February 07, 2013

The glass ceiling and the welfare ceiling

Mother of two is trapped in the welfare system. With an income of $19,000 she qualifies for nearly $81,000 in benefits according to the Blaze panel tonight, many of which would be lost if she made more money--child care, SNAP, Medicaid, SCHIP, Section 8, earned income tax credit, heat, phone, etc. Another example from Pennsylvania in mid-2012 was of a statistical mother of 2 earning $29,000 gross income is better off than earning $69,000 gross because of entitlements she receives at the lower income. And if people say this is a trap, they are cruel, haters, racists, etc.

She can earn $57,000 and still get SCHIP; she can earn $45,000 and get child care and SCHIP; but why do that when at $29,000 she can also get food stamps, housing and heat as well as medical and child care? Look what she would lose if she got a promotion--or got married?

http://www.aei.org/files/2012/07/11/-alexander-presentation_10063532278.pdf